Bussiness Investment Comparison

When it comes to real estate, UAE cities Dubai and Abu Dhabi are two of the most popular destinations. Both have favorable regulatory environments, which have created a strong demand for residential and commercial property. Additionally, both cities have substantial new development projects. And the impending Expo 2020 has further fueled interest in real estate in the UAE.

Although both cities are great for property investment, the two cities are different in terms of climate, infrastructure, and other factors. Abu Dhabi is smaller and quieter, while Dubai is more developed. Both cities are relatively expensive, but they have some key differences that should be considered when deciding on a property investment.

Abu Dhabi has a booming economy and a rapidly growing job market. Its GDP is $268 billion and its per capita income is $96,000. Moreover, there is zero taxation on rental income, making Abu Dhabi an excellent investment option. Rental yield returns in Abu Dhabi are high, and the purchase price per square meter is one of the lowest in the world.

dubai vs abu dhabi investment comparison

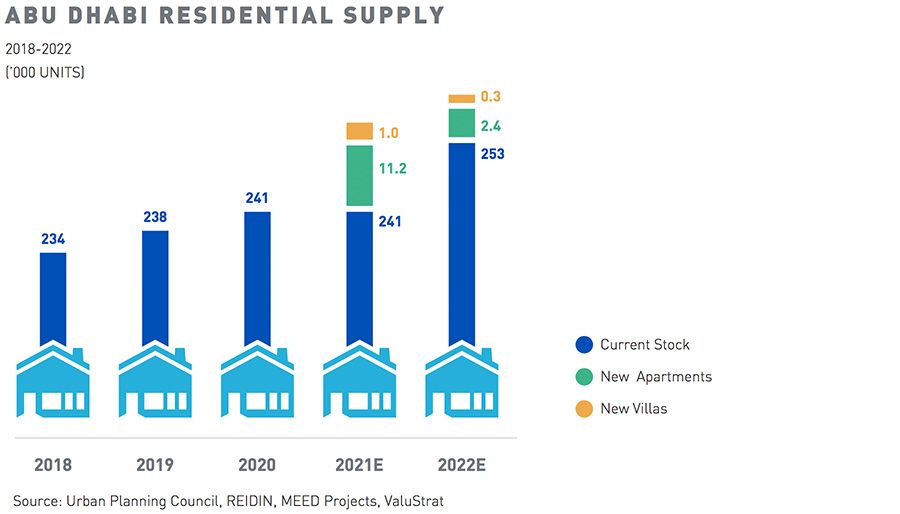

Abu Dhabi’s residential supply is much tighter than Dubai, but its real estate market is experiencing a growth in demand. Additionally, Abu Dhabi has an ambitious plan to attract global entrepreneurs and technology specialists to develop the city. The city aims to be the “smartest” city in the Middle East by 2020. To achieve this goal, the Abu Dhabi Investment Office has launched the $545 million Innovation Programme to support innovative ideas. This program helps accelerate the growth of the city and make life more enjoyable for residents.

Dubai Vs Abu Dhabi Bussiness Investment Comparison

The UAE is home to several prominent sovereign wealth funds. The Abu Dhabi Investment Authority (ADFA) is the second largest sovereign wealth fund in the world, with over $200 billion under management. This fund is financed by government revenues, primarily from oil and related hydrocarbons. With that money, the government has sought to diversify the economy and create a stronger, more diversified economy.

investment comparison between dubai and abu dhabi

The UAE has a diverse economy. The largest contributor to GDP is the wholesale and retail sector, which accounts for 22.7% of GDP. Other significant sectors include manufacturing, real estate, and tourism. Dubai is also home to the Dubai International Financial Centre (DIFC), which acts as a bridge between the east and west markets. The DIFCO is the most successful financial center in the GCC region, and is expected to continue growing for the next few years.

which is better for investment dubai or abu dhabi

There are many advantages to investing in real estate in the UAE. Tourism has become an important part of the economy, with the contribution to GDP rising from three percent in the mid-1990s to 16.5% in 2010. Tourism also drives government spending, and over 47 billion dollars are invested annually in various touristic projects.

The residential capital value in Abu Dhabi has reached a five-year high. The most lucrative areas of the city include Al Raha, Al Reef, and Saadiyat Island. With these developments, the UAE’s real estate market is set to continue gaining momentum. Moreover, the government is implementing a number of new initiatives that aim to make it more attractive to expatriates.